Corporate Governance

Ensure strong corporate governance oversight, including an effective risk management framework to support a growing organization.

Corporate Governance Practices to Support a Growing Organization

Bridgewater continues to build-out and enhance its corporate governance practices following the initial public offering in 2018 and strong growth trajectory over the past few years. By making incremental investments in our enterprise risk management program, conducting our first Say-on-Pay vote in 2024, and formalizing our ESG program, we are creating a scalable corporate governance framework to support our organization for years to come.

Board of Directors

Board Structure

As of December 31, 2023, we had 10 directors on our Board, including eight independent directors. The Board provides oversight of our business and monitors the performance of our management teams through the Board's Audit Committee, Compensation Committee, and Nominating and ESG Committee, all of which include only independent directors.

Since our formation, the positions of Chairperson and Chief Executive Officer have been combined and held by Jerry Baack. We believe this Board leadership structure is the most appropriate for Bridgewater because of the efficiencies achieved with the joint role, and because the knowledge of our day-to-day operations and business that our CEO possesses greatly enhances the decision-making process of the Board as a whole. Because of our joint Chairman/Chief Executive Officer role, the Board felt it was prudent to appoint a lead independent director. David Juran currently serves in this role and fulfills the duties outlined in our Corporate Governance Guidelines.

Enhancing our overall corporate governance remains a focus for us and in 2023, our shareholders approved a proposal to eliminate the classified board structure. Commencing at the 2024 Annual Meeting of Shareholders, directors standing for election will be elected for a term of one year rather than a term of three years.

With a strong lead independent director, a declassified board structure, Board committees composed only of independent directors, and the efficiencies achieved in having the roles of Chairman and Chief Executive Officer combined, the Board feels the appropriate structure is in place to ensure we meet the expectations of our shareholders.

More information on our Board of Directors and committees can be found here.

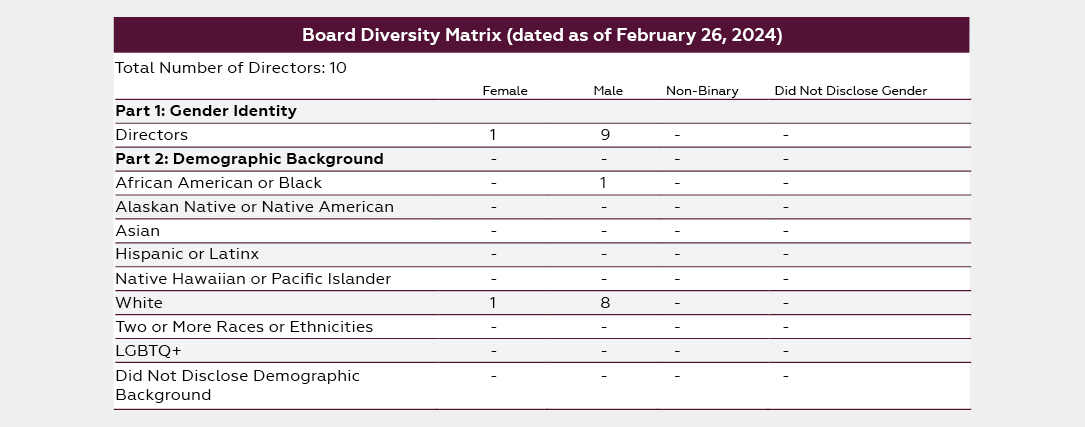

Board Diversity

The Nominating and ESG Committee regularly assesses the diversity of the Board, including tenure, gender, ethnicity, skills and perspective. The Board is composed of directors with a mix of tenure, with longer serving directors providing important experience and institutional knowledge and newer directors providing fresh perspective to deliberations. Our Board refreshment efforts have been active in recent years with 50% of our non-employee directors having been on the Board fewer than seven years.

The Board recognizes the importance of director diversity by gender and ethnicity and the positive impact this can have in terms of the perspectives and counsel the Board provides to management. As of December 31, 2023, 20% of the directors self-identified as women or ethnic minorities.

Executive Compensation

We compensate our executives through a combination of base salary, annual bonuses, equity awards, earnings credited under our Deferred Incentive Plan, and other benefits including perquisites. Notable attributes of our executive compensation program include the following:

What We Do

What We Don't Do

Independent compensation consultant retained by and reports to the Compensation Committee

No hedging of stock

Utilize a short-term incentive plan that includes performance-based incentives

No excessive perquisites

Minimum restricted stock vesting period of one year for employee participants

No repricing of stock options without shareholder approval

Peer group benchmarking

No “single trigger” severance upon a change-in-control

Utilize balanced mix of cash and equity compensation and annual and long-term incentives

No guaranteed annual bonus for executives

Conduct ongoing shareholder outreach and communications

No incentives that encourage improper risk taking

Set meaningful performance goals that align management with shareholder interests

The Board has adopted and annually reviews stock ownership and retention guidelines for non-employee directors as another way to align the long-term interests of directors with those of our shareholders. Within five years of the effective date of the policy or their election to the Board, directors are expected to own shares of common stock equal to or greater than four times the annual cash retainer of each director. As of December 31, 2023, all non-employee directors had either achieved the minimum stock ownership requirements or were making appropriate progress toward the requirements and were still within the permitted period for attaining the ownership requirements.

As an “emerging growth company” under the JOBS Act of 2012, Bridgewater was not required to include a Say-on-Pay proposal for shareholder vote until 2024. Starting in 2024, Bridgewater will conduct its first annual shareholder Say-on-Pay advisory vote.

Corporate Governance

Corporate Governance Guidelines

The Board adopted Corporate Governance Guidelines that govern all aspects of the Board including membership, leadership, nominations and criteria, term limits, expectations, board meetings, committees and independence.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics provides the ethical expectations we have for all officers, directors and employees every day. This policy covers the following:

- Honest and Ethical Conduct

- Conflicts of Interest

- Anti-Bribery

- Non-Discrimination

- Employees with Disabilities

- Harassment- and Violence-Free Workplace

- Privacy of Employee Information

Other Corporate Governance Policies

- Insider Trading Policy – prohibits insider trading of Bridgewater securities during certain blackout periods or while in possession of material, non-public information.

- Related Party Transaction Policy – provides oversight of potential transactions between Bridgewater and related persons, including directors and executive officers.

- Whistleblower Policy – ensures a channel of communication exists to report concerns about the conduct of Bridgewater or any of its people and to provide assurances that any such report will not result in retaliation

- Clawback Policy - requires the return of certain incentive compensation in the event of a financial restatement.

Stakeholder Engagement

We believe active two-way engagement with stakeholders is an important way to not only communicate our story, but also to solicit feedback from stakeholders about aspects of the business they feel are most important. For example, Bridgewater regularly meets with shareholders to discuss the company’s business model, strategy, and financials. We also integrate ESG into these discussions as a way to understand the views and expectations of our shareholders regarding ESG, specifically for small-cap banks like Bridgewater. We continue to use the ESG-related feedback we receive as we prioritize initiatives and build our ESG program moving forward. We look forward to maintaining ongoing dialogue to ensure we understand the evolving ESG views of our shareholders.

In 2023, we engaged with institutional shareholders owning approximately 8.5 million shares of Bridgewater common stock, representing over 50% of our total institutional ownership as of December 31, 2023.

Enterprise Risk Management (ERM)

Philosophy and Framework

Our risk management philosophy is to manage and mitigate dynamic risks while enhancing shareholder value, being responsive to clients, and delivering simple solutions in unconventional ways. We continue to make key investments in the scalability of our enterprise risk framework to support our growth trajectory and to help identify, quantify and manage emerging and evolving risks.

Our ERM framework has benefited significantly from a bank-wide approach to risk management led by our Chief Risk Officer and owned by leaders across all functions. The ERM program has continued to advance in preparation for continued growth and evolving risk landscapes. This includes the following:

- Proactively addressing emerging risks across all risk categories

- Continuing to scale the risk framework aligned with growth

- Leveraging technology to enhance processes and controls while driving responsiveness

- Reinforcing operational and financial resilience through all three lines of defense

- Enhancing organizational resiliency, specifically through active management of vendor/third-party risk management and fourth-party relationships

- Proactively making enhancements to ESG and DE&I programs as well as committing to recruitment and retention strategies

- Maintaining and enhancing a strong information security and cybersecurity risk management program

We are also focused on being well-positioned to proactively identify and mitigate emerging risks. Through a comprehensive Risk Appetite Statement and the recruitment and retention of highly skilled risk professionals, we are actively identifying, monitoring, measuring and managing risk across the organization. Additionally, Bridgewater is well positioned for regulatory and market changes through proactive capital management and implementation of Sarbanes-Oxley (SOX). Our strong and consistent credit underwriting, along with segment-specific expertise, are hallmarks of how we proactively manage credit risk. We take great pride in our risk management culture driven by robust team member engagement throughout the organization.

Oversight

Bridgewater’s full Board of Directors oversees enterprise risk management with each Board committee assuming a different and important role in overseeing the management of the risks we face. The management-level Enterprise Risk Management Committee (ERMC), led by our Chief Risk Officer, consists of our Strategic Leadership Team and other select functional leaders, is responsible for implementing and reporting to the Board regarding critical and emerging risks, the effectiveness of our control environment, our enterprise risk profile and the maturity of our risk management processes. The ERMC reports to both the full Board of Directors and the Audit Committee at least quarterly. We believe this division of risk management responsibilities presents a consistent, systemic and effective approach for identifying, managing and mitigating risks.

We provide ongoing, robust training programs to ensure team members across all three lines of defense know how to identify and mitigate potential issues. In 2023, training on various topics including bank security; Bank Bribery Act; anti-corruption; Community Reinvestment Act; harassment; Fair Lending; cyber security; data privacy; and identity theft was completed by all team members, including management. In addition, Bridgewater hosts an annual Training Day in which all team members receive annual regulatory compliance, Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) training, as well as other training specific to their role.

Bridgewater has a robust BSA/AML program in place to monitor and report suspicious activity while following customer identification and other regulatory guidelines. Annually, the BSA/AML program is independently audited to ensure we are adhering to legal and regulatory requirements as well as seeking continuous improvement of our program and systems.

Information and Data Security

We recognize that one of the most impactful emerging risks in our industry is cybersecurity. As a result, we have developed a proactive approach to identifying and addressing information and data security risks. Key attributes of this approach include the following:

- Investment in enhanced infrastructure and security protocols

- Partnership with industry-leading service providers to aid in monitoring

- Effective risk culture and awareness model with ongoing training initiatives

Bridgewater maintains a roadmap to ensure ongoing investment and enhancements to our cybersecurity program. In 2023, we continued to enhance our cybersecurity-related SOX Control framework, made improvements to identify access management processes, and further enhanced our critical vendor due diligence processes with an eye toward cyber and information security.

All team members are required to complete an annual information security training course. In addition, social engineering training and education is conducted throughout the year.

The ERMC provides an update on information and data security to the Board at least quarterly, with emerging issues being addressed more frequently as needed. Our Information Security program undergoes external audits on an annual basis and maintains cybersecurity insurance coverage.