Environmental Impact

Contribute to a healthier natural environment in the communities in which we live and work.

Doing Our Part

As a local bank in the Twin Cities with an efficient physical footprint, Bridgewater Bank has a relatively small direct environmental impact in our communities. However, we remain conscious of the impact we do have and have efforts in place to enhance our sustainability while being mindful of the resources we use. We are committed to doing our part to be good environmental stewards in the Twin Cities.

Maintaining a Small Physical Footprint

Bridgewater Bank has always operated with a “branch-light” service model. As a $4.6 billion bank, Bridgewater has just seven branches, including our corporate center. By comparison, the average publicly-traded bank of our size has nearly 40 branches. This means we are still able to provide our always-responsive level of service to our clients, but do so while using fewer resources as an organization.

Bridgewater Bank Corporate Center

In August 2020, we opened Bridgewater Bank Corporate Center in St. Louis Park, Minnesota. We deployed an energy conservation strategy in the design and construction of this state-of-the-art facility through participation in the Energy Design Assistance Program with our local utility providers.

For the second consecutive year, the Bridgewater Bank Corporate Center earned ENERGY STAR® certification from the U.S. Environmental Protection Agency (EPA). ENERGY STAR certified buildings are verified to perform in the top 25% of buildings nationwide, based on weather-normalized source energy use criteria that considers occupancy, hours of operation and other key metrics. The next time you visit, check out the little blue label on display at our entrance – it represents proven, verified superior energy performance over a 12-month period. By meeting strict standards, Bridgewater is saving energy, saving money and helping protect the environment by generating fewer greenhouse gas emissions than typical buildings.

For more than 20 years, the EPA’s ENERGY STAR program has been America’s resource for saving energy and protecting the environment – today, thousands of facility owners and managers use ENERGY STAR to improve the energy performance of their buildings.

Across our corporate center and other branches, we have several environmental features and initiatives in place:

- Nearly exclusive LED lighting across all facilities, including the use of lighting efficiency software

- Automatic water faucet shut-offs in restrooms

- Drinking fountains and water machines include water bottle filling stations (saved an average of nearly 6,500 plastic bottles per month in 2023, up 10% from 2022)

- Two electric vehicle (EV) charging stations

- Automated HVAC control system to better monitor and regulate temperatures and energy usage

- Provide and encourage use of dishes and silverware instead of paper plates and plastic utensils

- Use of multi-function copiers eliminates need for personal printers, reduces excess printing and increases document security

- Reduced printing with general transition to electronic meeting materials

- Created a net positive carbon impact by installing new carpet with the highest sustainability rating in the Bridgewater Corporate Center in 2023

Technology

Paperless Processes

At Bridgewater, investment in technology not only helps to enhance the client experience, it helps support our priority to do our part to contribute to a healthier environment. In recent years, we have taken steps to integrate digital technology into both client-facing and back-office processes to reduce our use of paper.

For example, in January 2023 we implemented Electronic Signature Capture at all client-facing servicing desks. This technology streamlines a multitude of processes including deposit account opening, file maintenance requests and some teller transactions by eliminating the need to print or provide paper documents to capture a client signature.

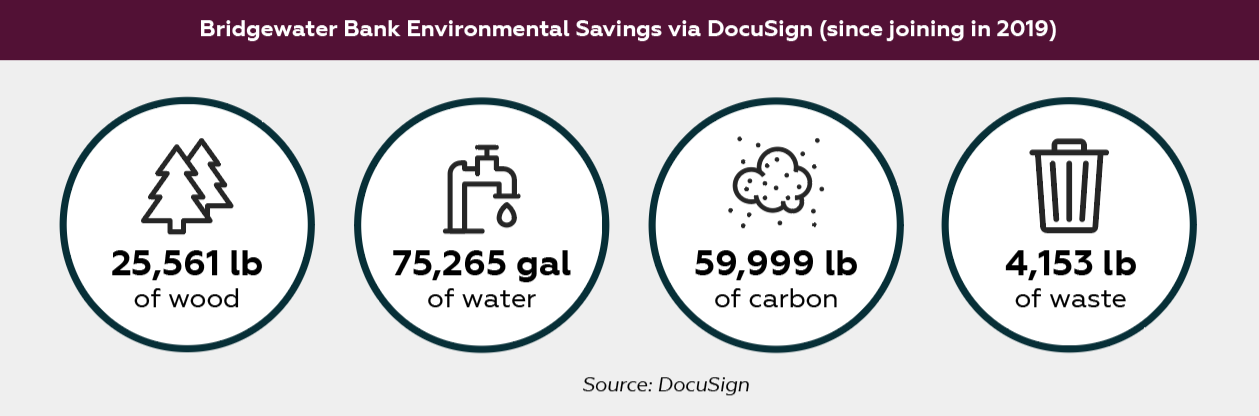

In addition, through the organization-wide adoption of DocuSign, we have meaningfully reduced the paper we use for account openings and loan originations. We also adopted Integrated Teller which eliminated deposit slips, transaction tickets and other paper usage from our day-to-day branch processes.

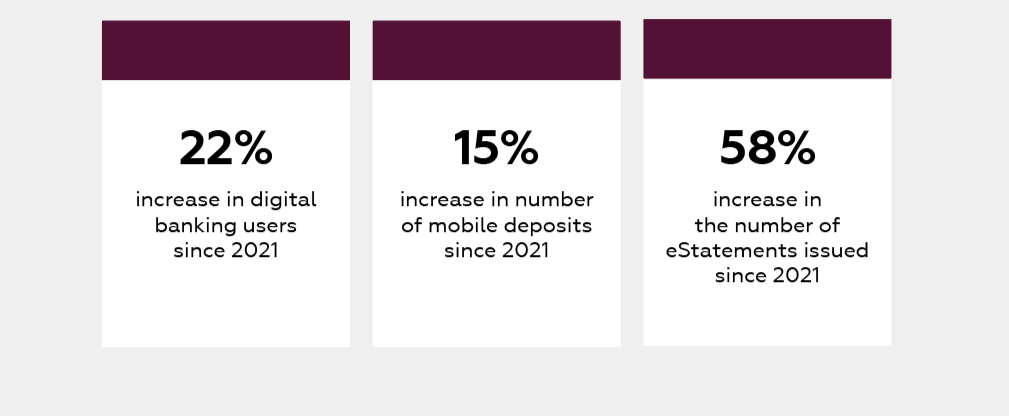

Enhancements to our online and mobile banking platforms have resulted in a 22% increase in digital banking users since 2021. This includes a 15% increase in the number of mobile deposits, which not only reduces paper usage, but reduces fossil fuel usage to get to and from our branches. In addition, we continue to see increases in eStatement adoptions.

Recycling Initiatives

Bridgewater Bank partners with PCs for People for its recycling and destruction of old and unused technology equipment. PCs for People is a national nonprofit whose mission is to provide low-income individuals, families, and non-profits with no or low-cost quality computers and internet to advance digital inclusion in its communities.

Since the beginning of our partnership in 2020, we have recycled more than 300 computers, over 160 of which were able to be refurbished and distributed within the community. These computers have gone on to support over 320 individuals, including 165 children. The recycled and refurbished equipment that we have provided to PCs for People not only supports our community, but the environment as well as the equipment we have donated has saved over three tons of electronic waste from our landfills.